Cryptocurrency mining has evolved dramatically since Bitcoin’s early days, when enthusiasts could mine blocks using simple home computers. Today, professional mining operations dominate the landscape, powered by specialized hardware called ASIC miners. But what exactly are these machines, and why have they become indispensable in modern crypto mining?

ASIC (Application-Specific Integrated Circuit) miners represent the cutting edge of mining technology – purpose-built computers designed exclusively for cryptocurrency mining. Unlike the general-purpose processors in your laptop or gaming PC, these devices sacrifice all other functionality to focus on one task: solving the cryptographic puzzles that secure blockchain networks with maximum efficiency.

The introduction of ASIC miners revolutionized cryptocurrency mining by offering performance improvements measured in orders of magnitude over previous solutions. However, their specialized nature brings both advantages and challenges that every potential miner must understand. From their technical architecture to profitability considerations and market dynamics, ASIC miners represent a significant investment that requires careful evaluation.

What Is an ASIC Miner?

An ASIC miner (Application-Specific Integrated Circuit miner) is a specialized computer designed solely for mining cryptocurrencies. Unlike general-purpose hardware like CPUs or GPUs, ASIC miners are built to perform one task with maximum efficiency: solving the cryptographic puzzles required to validate blockchain transactions.

These machines are algorithm-specific, meaning each ASIC is hardwired to mine only certain cryptocurrencies. For example:

-

Bitcoin ASICs (SHA-256 algorithm)

-

Litecoin ASICs (Scrypt algorithm)

-

Kaspa ASICs (kHeavyHash algorithm)

ASIC miners dominate professional mining due to their unmatched speed and energy efficiency, but they lack flexibility—once a coin’s mining algorithm changes, the ASIC may become obsolete.

How Did We Get From CPU Mining to ASIC Miners?

The evolution of mining hardware tells an interesting story about cryptocurrency’s growth.

In Bitcoin’s early days (2009-2010), people mined using regular computer CPUs. Then, miners discovered GPUs (graphics cards) were much faster. By 2011, Field Programmable Gate Arrays (FPGAs) offered another leap in performance. But the real game-changer came in 2013 with the first ASIC miners.

The Mining Hardware Timeline

| Year | Technology | Hashrate Improvement |

|---|---|---|

| 2009 | CPU | Baseline (1x) |

| 2010 | GPU | 50-100x faster |

| 2011 | FPGA | 5-10x over GPU |

| 2013 | ASIC | 1000x over CPU |

This arms race happened because more miners joined the network, making mining difficulty increase exponentially. Specialized hardware became necessary to stay competitive.

How Does an ASIC Miner Actually Work?

Understanding ASIC miner operation helps you make better buying decisions.

ASIC stands for Application-Specific Integrated Circuit. Here’s the step-by-step process:

-

Problem Reception: The miner receives a cryptographic puzzle from the network

-

Brute Force Solving: It tries trillions of possible solutions per second

-

Solution Verification: When it finds a potential solution, it checks if it’s correct

-

Block Reward: If correct, the miner earns cryptocurrency as reward

Key Components Inside an ASIC Miner

-

Hashboard: Contains the actual ASIC chips doing computations

-

Control Board: Manages operations and network connection

-

Power Supply: Provides precise voltage to hashboards

-

Cooling System: Fans or liquid cooling to prevent overheating

What Factors Should You Consider When Choosing an ASIC Miner?

Picking the right ASIC miner requires balancing multiple technical and economic factors.

Hashrate: Your Mining Power

Hashrate measures how many calculations the miner can perform each second. Higher is better, but consider:

-

Current network difficulty

-

Your electricity costs

-

Miner’s efficiency

Power Consumption: The Hidden Cost

ASIC miners consume substantial electricity. For example:

| Model | Power Consumption |

|---|---|

| Antminer S19 | 3250W |

| Whatsminer M30S | 3400W |

| Goldshell KD5 | 2450W |

Energy Efficiency: Hashrate per Watt

This ratio determines your profitability. Calculate it as: Efficiency = Hashrate (TH/s) ÷ Power (W)

Upfront Cost vs Long-Term Profit

High-end models cost more but often prove more profitable over time. Consider:

-

Initial purchase price

-

Expected lifespan

-

Resale value

Noise Levels: The Practical Concern

ASIC miners are loud – some reach 75dB. This affects where you can install them:

-

75dB: Like a vacuum cleaner – needs a separate room

-

65dB: Office noise level – tolerable with insulation

-

55dB: Normal conversation – rare for ASICs

User-Friendliness: For Beginners

Some miners offer:

-

Plug-and-play setup

-

Intuitive interfaces

-

Remote management

How Do You Actually Use an ASIC Miner? A Step-by-Step Guide

Setting up your first ASIC miner isn’t as hard as you might think.

-

Unboxing and Inspection

-

Check for shipping damage

-

Verify all components are present

-

-

Power Connection

-

Use the correct voltage (usually 220V)

-

Ensure the circuit can handle the load

-

-

Network Setup

-

Connect via Ethernet for stability

-

Assign a static IP if needed

-

-

Configuration

-

Access web interface (typically 192.168.1.99)

-

Enter pool information

-

Set worker name/password

-

-

Monitoring

-

Track the hashrate and temperature

-

Watch for hardware errors

-

How Does ASIC Miner Impact Profitability?

ASIC miners are powerful tools for cryptocurrency mining, but their profitability depends on several critical factors. Unlike general-purpose hardware, ASIC miners are designed for maximum efficiency in mining specific cryptocurrencies. However, their profitability isn’t guaranteed—it fluctuates based on costs, market conditions, and operational expenses.

In this section, we’ll break down the key elements that determine whether an ASIC miner will be profitable for you.

Key Cost Considerations:

-

Purchase Price

-

Entry-level ASIC miners: $1,000–$3,000

-

High-performance models (e.g., Antminer S19 Pro): $3,000–$6,000

-

Specialized miners (e.g., Goldshell KD6 for Kadena): $10,000+

-

-

Depreciation & Obsolescence

-

Newer, more efficient models reduce the value of older miners

-

Some miners lose 30–50% of their value in the first year

-

-

Maintenance & Repairs

-

Fan replacements, power supply issues, and hashboard failures add costs

-

Budget 5–10% of the miner’s cost annually for maintenance

-

| ASIC Model | Initial Cost | 1-Year Resale Value | Depreciation Rate |

|---|---|---|---|

| Antminer S19j Pro | $4,000 | $2,400 | 40% |

| Whatsminer M50 | $5,500 | $3,300 | 40% |

| Goldshell KD6 | $12,000 | $7,200 | 40% |

Takeaway: A higher upfront cost doesn’t always mean better profitability—you must calculate the payback period based on mining rewards and depreciation.

How Do Electricity Costs Affect ASIC Miner Profitability?

Electricity is the biggest ongoing expense in ASIC mining. If power costs are too high, mining can become unprofitable even with a high hashrate.

Key Factors in Power Costs:

-

Electricity Rates per kWh

-

<$0.06/kWh: Highly profitable (e.g., hydropower regions)

-

$0.06–$0.12/kWh: Moderately profitable

-

>$0.15/kWh: Risky, often unprofitable

-

-

Power Efficiency (J/TH)

-

More efficient miners (e.g., 30 J/TH) save significantly on electricity

-

Older models (e.g., 100 J/TH) may cost more in power than they earn

-

-

Infrastructure Costs

-

Home Mining: May require electrical upgrades (220V circuits, PDUs)

-

Industrial Mining: Requires transformers, cooling systems, and backup power

-

Example: Mining at Different Electricity Rates

| Miner | Power Use | $0.06/kWh Profit | $0.12/kWh Profit | $0.18/kWh Profit |

|---|---|---|---|---|

| Antminer S19 | 3250W | $12/day | $6/day | Loses $2/day |

| Whatsminer M30S | 3400W | $11/day | $5/day | Loses $3/day |

| Goldshell KD5 | 2450W | $15/day | $9/day | $3/day |

Takeaway: Mining is only profitable if electricity costs are low enough to leave a margin after operational expenses.

How Do Market Trends Impact ASIC Miner Profitability?

Cryptocurrency markets are volatile, and mining profitability changes daily. Key market factors include:

1. Cryptocurrency Price Movements

-

Higher Bitcoin/Ethereum prices = higher mining rewards (in USD terms)

-

Bear markets squeeze profitability as mining revenue drops

2. Network Difficulty Adjustments

-

More miners = higher difficulty = lower rewards per miner

-

Example: Bitcoin’s difficulty increases every 2 weeks

3. Regulatory Changes

-

Some countries ban mining (e.g., China’s 2021 crackdown)

-

Others offer incentives (e.g., Texas, Canada, Iceland)

4. Technological Advancements

-

New ASIC models (e.g., 3nm chips) make older miners obsolete

-

Efficiency improvements reduce power costs for newer miners

Historical Example: Bitcoin Halving Events

| Year | BTC Price Before Halving | Post-Halving Price (1 Year Later) | Miner Profitability Impact |

|---|---|---|---|

| 2016 | ~$650 | ~$2,500 | Short-term drop, then 4x surge |

| 2020 | ~$8,500 | ~$55,000 | Initial squeeze, then huge profits |

| 2024 | ~$40,000 | TBD | Expected short-term decline, then recovery |

Takeaway: Market cycles play a huge role—mining during bull runs is far more profitable than in bear markets.

Why Choose ASIC Over GPU Mining?

ASIC miners dominate cryptocurrency mining for good reasons.

Performance Comparison

| Metric | ASIC Miner | GPU Rig |

|---|---|---|

| Hashrate | 100 TH/s | 1 GH/s |

| Power Efficiency | 30 J/TH | 500 J/TH |

| Initial Cost | $3,000 | $6,000 |

| Flexibility | One algorithm | Multiple coins |

When Does GPU Mining Make Sense?

-

Mining alternative cryptocurrencies

-

When electricity is very expensive

-

If you need multi-purpose hardware

What Are the Pros and Cons of ASIC Mining?

Understanding both sides helps make informed decisions.

Advantages

-

Unmatched Efficiency: 100x more efficient than GPUs

-

Higher Profitability: When conditions are right

-

Reliability: Designed for 24/7 operation

-

Simplicity: Single-purpose devices

Disadvantages

-

Algorithm Lock-in: Can’t switch coins

-

Obsolescence Risk: New models make old ones worthless

-

Noise and Heat: Requires a proper environment

-

High Entry Cost: Quality miners aren’t cheap

Which Cryptocurrencies Can You Mine With an ASIC?

Not all cryptocurrencies are ASIC-minable by design.

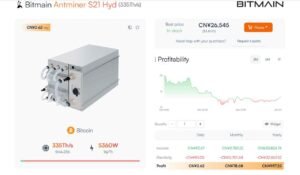

Major ASIC-Compatible Coins

-

Bitcoin (SHA-256)

Bitmain Antminer S23 Hyd 3U (1.16 Ph)

Bitmain Antminer S21e XP Hyd 3U (860Th)

Bitmain Antminer S23 Hyd (580Th) -

Litecoin (Scrypt)

Volcminer D1 Hydro (30Gh)

ElphaPex DG2+(20.5Gh)

Bitmain Antminer L9 (17Gh) -

Kaspa (kHeavyHash)

Bitmain Antminer KS7 (40Th)

Iceriver KAS KS7 (40Th)

Goldshell KA-BOX PRO(1.6Th) -

ALEO (zkSNARK)

Iceriver ALEO AE2 (720Mh)

Iceriver ALEO AE1 Lite (300Mh)

Goldshell AE Max (360Mh)

ASIC-Resistant Coins

These coins deliberately prevent ASIC mining:

-

Ethereum Classic

-

Ravencoin

-

Monero

How Long Do ASIC Miners Typically Last?

ASIC lifespan affects your total return on investment.

Expected Lifespans

| Usage Level | Expected Lifespan |

|---|---|

| 24/7 Heavy Use | 1.5-2 years |

| Moderate Use | 2-3 years |

| Light Use | 3-4 years |

Factors Affecting Longevity

-

Operating Temperature: The Cooler is better

-

Power Stability: Surges damage components

-

Maintenance: Regular cleaning helps

-

Manufacturer Quality: Some brands last longer

What’s the Resale Market Like for Used ASIC Miners?

The secondary market for ASIC miners is surprisingly active.

Current Resale Value Examples

| Model | New Price | 1-Year-Old Price |

|---|---|---|

| Antminer S19j Pro | $3,000 | $1,800 |

| Whatsminer M30S | $2,500 | $1,400 |

| Goldshell KD5 | $6,000 | $3,500 |

Where to Sell Used Miners

-

Specialized Marketplaces: Like our platform(X ON MINING)

-

Mining Communities: Forums and Discord groups

-

Local Classifieds: For face-to-face deals

Conclusion

What Is an ASIC Miner? ASIC miners are the ultimate tools for serious cryptocurrency mining, offering unmatched efficiency and hash power for specific algorithms. While their high performance comes with trade-offs—like high upfront costs, noise, and lack of flexibility—they remain the most profitable choice for mining Bitcoin and other major cryptocurrencies.

Before investing, carefully consider electricity costs, mining difficulty, and market conditions to ensure long-term profitability. Whether you’re a large-scale operation or an individual miner, choosing the right ASIC model can make all the difference in your mining success.

Explore the latest ASIC Miners right away

FAQs

Can ASIC miners be used for anything besides mining?

No, they’re single-purpose devices designed specifically for mining particular cryptocurrencies.

How much internet data does ASIC mining use?

Surprisingly little – about 100MB per day for most miners.

Do ASIC miners come with warranties?

Most manufacturers offer 180-day to 1-year warranties, though conditions vary.

Can I run an ASIC miner at home?

Yes, but consider noise, heat, and electrical capacity. Many prefer dedicated facilities.

How often do ASIC miners need maintenance?

Basic cleaning every 3-6 months is recommended for optimal performance.