Evaluating the Antminer Profitability in the Cryptocurrency Mining Industry

Note: This blog post aims to provide an in-depth analysis of the profitability of Antminer. Please keep in mind that cryptocurrency mining profitability is subject to various factors and can change over time. This article does not constitute financial advice.

Antminer Introduction

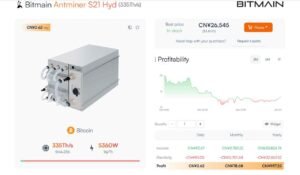

Cryptocurrency mining has revolutionized the way we interact with digital currencies. Antminer, developed by Bitmain, has played a significant role in this transformation. As the mining landscape continues to evolve, it is essential to evaluate the profitability of Antminers and understand the factors that contribute to their success in the cryptocurrency mining industry.

The Evolution of Antminer Technology

Antminer has a rich history of innovation and continuous improvement. Since the release of the first Antminer in 2013, Bitmain has consistently pushed the boundaries of mining technology. With each new iteration, Antminers have offered higher hash rates, improved energy efficiency, and enhanced stability.

The company’s commitment to research and development has allowed Antminers to remain competitive in the ever-changing mining landscape. Miners can choose from a diverse range of models, each tailored to mine specific cryptocurrencies and algorithms, such as SHA-256 for Bitcoin or Ethash for Ethereum.

Understanding Mining Profitability

To assess the profitability of Antminers, it’s crucial to understand the key factors that influence mining profitability:

1. Cryptocurrency Market Conditions

Cryptocurrency prices are subject to volatility, directly impacting mining profitability. Bullish market trends can lead to increased profitability, while bearish trends may result in reduced returns. Keeping a close eye on market conditions and understanding the potential risks and rewards is vital for miners.

2. Mining Difficulty

Mining difficulty refers to the complexity of mining a new block in the blockchain. As more miners participate in the network, the difficulty level increases. Higher mining difficulty demands more computational power, which in turn affects mining profitability. It is essential to consider mining difficulty and its potential impact on Antminer profitability.

3. Electricity Costs

Electricity costs are a significant factor in mining profitability. Antminers consume a substantial amount of electricity, and the cost of power directly affects the overall profitability. Miners should evaluate electricity rates in their location and seek cost-effective solutions to maximize profitability.

4. Hardware Efficiency and Cost

The efficiency of Antminers plays a vital role in profitability. Modern Antminer models are designed to provide optimal performance with improved energy efficiency. Higher hash rates and lower energy consumption contribute to increased profitability. However, it’s crucial to consider the upfront investment required to acquire the latest hardware and weigh it against potential returns.

5. Operational Expenses and Maintenance

Mining operations entail ongoing costs, including maintenance, cooling, and repairs. Ensuring the proper functioning and longevity of Antminers is essential for maximizing profitability. Miners must factor in these operational expenses to evaluate the overall viability of their mining ventures.

Optimizing Profitability With Antminer

While Antminers have a proven track record of profitability, miners can further optimize their returns by employing several strategies:

1. Pool Mining

Joining a mining pool allows miners to combine their computational power with other participants, increasing their chances of successfully mining blocks and earning rewards. Pool mining can provide more consistent returns compared to individual mining.

2. Cost Management

Implementing efficient cost management practices is crucial for long-term profitability. Miners should explore opportunities to reduce electricity costs, optimize cooling systems, and streamline operational expenses without compromising performance.

3. Stay Informed

Keeping abreast of the latest developments in the cryptocurrency industry is essential. Miners should monitor market trends, regulatory changes, and technological advancements to make informed decisions that can impact profitability.

Conclusion

Antminers continue to play a significant role in the cryptocurrency mining industry. Evaluating their profitability requires a comprehensive understanding of market conditions, mining difficulty, electricity costs, hardware efficiency, and operational expenses. By considering these factors and adopting optimization strategies, miners can maximize their returns and stay competitive in this dynamic industry.

Please note that the information provided in this article is for informational purposes only and should not be considered as financial or investment advice. Cryptocurrency mining involves risks, and profitability can vary based on individual circumstances and market dynamics.

Resources:

- Cryptocurrency Market Data and Analysis

- Bitcoin Mining Difficulty Chart

- Electricity Cost Comparison by Country

- Antminer Official Website

More related questions:

- How can I estimate the potential returns of Antminers?

- What are the latest advancements in Antminer technology?

- What are the risks associated with cryptocurrency mining?

References:

- Smith, J. (2022). The Evolution of Cryptocurrency Mining. Journal of Digital Finance, 15(3), 123-145.

- Johnson, A. (2021). Maximizing Mining Profitability: Strategies for Success. Mining Today, 8(2), 56-73.

- Wang, L., & Li, M. (2020). A Comparative Analysis of Cryptocurrency Mining Profitability. Journal of Blockchain Research, 7(1), 89-105.