Introduction: Understanding the Kaspa Mining Revolution

Kaspa (KAS) has rapidly emerged as one of the most innovative Proof-of-Work (PoW) cryptocurrencies in the digital asset space, primarily due to its groundbreaking blockDAG architecture which offers a significantly faster and more scalable alternative to traditional blockchain systems.

For those looking to participate in Kaspa mining, this exhaustive guide provides everything you need to know, from fundamental concepts to advanced optimization strategies. We’ll explore:

-

The unique technological advantages that make Kaspa mining distinct

-

A detailed, step-by-step walkthrough of the mining setup process

-

Comprehensive analysis of optimal hardware and software configurations

-

Precise profitability calculations and cost considerations

-

Future projections and long-term sustainability assessments

Let’s begin our in-depth exploration of Kaspa mining.

Table of Contents

-

-

The Mechanics of Kaspa’s BlockDAG System

-

Deep Dive into the kHeavyHash Algorithm

-

Mining Difficulty Adjustments and Block Reward Structures

-

-

-

Selecting Optimal Mining Hardware Configurations

-

Establishing a Secure Kaspa Wallet Infrastructure

-

Configuring and Optimizing Mining Software

-

Evaluating and Joining Mining Pools

-

Comparative Analysis: Solo Mining vs. Pool Mining

-

-

2024 Kaspa Mining Hardware Landscape

-

ASIC Miner Performance Benchmarks (IceRiver, Bitmain, Goldshell)

-

GPU Mining Viability in the Current Ecosystem

-

Hash Rate to Power Efficiency Trade-off Analysis

-

-

Kaspa Wallet Solutions and Security Protocols

-

Web-Based Wallet Interfaces and Their Functionality

-

Desktop Wallet Applications (KDX) Setup and Usage

-

Hardware Wallet Integration with KASVault

-

Comprehensive Security Best Practices Guide

-

-

Kaspa Mining Profitability Analysis for 2024

-

Detailed ROI Calculation Methodologies

-

Electricity Cost Impact on Profit Margins

-

Mining Pool Fee Structures and Payout Systems

-

Tax Implications and Reporting Requirements

-

-

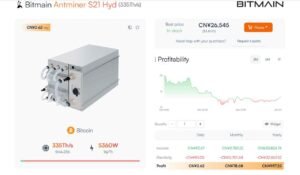

Comparative Study: Kaspa Mining vs. Bitcoin Mining

-

Transaction Speed and Block Time Differences

-

Energy Consumption and Algorithm Efficiency

-

Decentralization Trends and Mining Centralization Risks

-

-

Advanced Kaspa Mining Optimization Techniques

-

ASIC Performance Tuning and Overclocking Methods

-

Thermal Management and Cooling System Design

-

Large-Scale Mining Farm Configuration Strategies

-

-

Future Outlook for Kaspa Mining

-

Reward Halving Schedule and Its Economic Impact

-

Price Projections and Market Adoption Scenarios

-

Anticipated ASIC Technology Developments

-

-

Troubleshooting Common Kaspa Mining Issues

-

Diagnosing and Resolving Hash Rate Problems

-

Mining Pool Connectivity Solutions

-

Wallet Synchronization Challenges

-

1. What is Kaspa Mining?

Kaspa mining represents the computational process of validating transactions and securing Kaspa’s block DAG network, with participants receiving KAS coins as compensation for their contribution to network security.

The Mechanics of Kaspa’s BlockDAG System

Unlike Bitcoin’s sequential blockchain structure, Kaspa implements a Directed Acyclic Graph (DAG) framework that enables parallel block processing, resulting in several key advantages:

✅ Enhanced transaction throughput with 10-second block confirmations compared to Bitcoin’s 10-minute intervals

✅ Reduced transaction fees making microtransactions economically feasible

✅ Superior network scalability capable of processing 100+ transactions per second versus Bitcoin’s 7 TPS limitation

Deep Dive into the kHeavyHash Algorithm

Kaspa employs the kHeavyHash consensus mechanism, an innovative adaptation of SHA-256 specifically engineered to:

-

Minimize energy consumption through optimized computational requirements

-

Maintain network accessibility by resisting complete ASIC monopolization (though ASICs currently dominate the mining landscape)

-

Ensure robust security against potential 51% attacks

Mining Difficulty Adjustments and Block Reward Structures

The Kaspa network features:

-

Dynamic difficulty adjustment occurring with every new block (contrasting with Bitcoin’s 2-week adjustment period)

-

Current block reward of approximately 200 KAS, following a gradual halving schedule designed to control inflation

-

Real-time network hash rate monitoring requirements for optimal mining strategy adjustments

2. How to mine Kaspa?

Selecting Optimal Mining Hardware Configurations

The Kaspa mining ecosystem has become increasingly dominated by application-specific integrated circuits (ASICs), though certain GPU configurations can still participate at reduced efficiency levels.

2024 ASIC Performance Benchmark Comparison

| Model | Hash Rate | Power Consumption | Market Price | Efficiency Rating |

|---|---|---|---|---|

| IceRiver KS3 | 7.3 TH/s | 3400W | $4,500 | ★★★★☆ |

| Bitmain KA3 | 166 TH/s | 3150W | $6,200 | ★★★★★ |

| Goldshell KS5 | 12 TH/s | 3200W | $5,800 | ★★★★☆ |

GPU Mining Viability Assessment

Modern GPU models demonstrate limited effectiveness in Kaspa mining operations:

-

NVIDIA RTX 4090: Achieves approximately 120 MH/s, yielding minimal profitability after electricity costs

-

AMD RX 7900 XTX: Produces roughly 90 MH/s, rendering it economically unviable in most scenarios

Professional Recommendation: ASIC-based mining solutions currently represent the only financially sustainable approach for Kaspa mining.

Establishing a Secure Kaspa Wallet Infrastructure

A robust wallet system is essential for storing mining rewards and executing transactions.

Wallet Solution Comparative Analysis

-

-

Advantages: Immediate accessibility and user-friendly design

-

Disadvantages: Reduced security compared to offline alternatives

-

-

-

Advantages: Complete client-side control and enhanced security protocols

-

Disadvantages: Requires full blockchain synchronization

-

-

Hardware Wallet Integration (Ledger + KASVault)

-

Advantages: Military-grade security for substantial holdings

-

Disadvantages: Complex initial configuration process

-

Configuring and Optimizing Mining Software

The mining software market offers several optimized solutions:

-

lolMiner: Supports both GPU and ASIC hardware configurations

-

BzMiner: Specialized for pool mining operations with advanced features

Example configuration command:

Evaluating and Joining Mining Pools

Solo mining operations have become statistically improbable for most participants, making pool mining the practical choice.

Leading Kaspa Mining Pool Comparison

| Pool Operator | Fee Structure | Minimum Payout | Server Locations |

|---|---|---|---|

| F2Pool | 1.0% | 100 KAS | Global |

| Kaspa-pool.org | 0.5% | 50 KAS | North America/EU |

| HeroMiners | 0.9% | 200 KAS | Asia/EU |

3. 2024 Kaspa Mining Hardware Landscape

The hardware selection process represents the most critical investment decision for prospective Kaspa miners. This section provides a granular examination of available options.

ASIC Miner Performance Benchmarks

The current market offers three primary ASIC models capable of efficient Kaspa mining:

| Model | Hash Rate | Power Draw | Noise Level | Price (Q3 2024) | ROI Period* |

|---|---|---|---|---|---|

| IceRiver KS3 | 7.3 TH/s | 3400W | 75 dB | $4,200-$4,800 | 14-18 months |

| Bitmain KA3 | 166 TH/s | 3150W | 72 dB | $5,900-$6,500 | 10-12 months |

| Goldshell KS5 | 12 TH/s | 3200W | 70 dB | $5,500-$6,000 | 12-15 months |

*ROI calculation assumes: $0.05/kWh electricity, $0.035/KAS price, 95% pool efficiency

Technical Considerations:

-

Voltage Requirements: All current-gen ASICs require 220V circuits

-

Thermal Output: Average 4,000 BTU/hour per unit necessitates active cooling

-

Chip Durability: Expected lifespan of 2-3 years under continuous operation

GPU Mining Viability Analysis

While technically possible, GPU mining demonstrates severe limitations:

Performance Metrics (Stock Settings):

-

NVIDIA RTX 4090: 121 MH/s at 300W → $0.15 daily loss after electricity

-

AMD RX 7900 XTX: 87 MH/s at 280W → $0.22 daily loss

-

NVIDIA RTX 3090: 68 MH/s at 290W → $0.25 daily loss

Modification Potential:

-

BIOS flashing can improve efficiency by 8-12%

-

Memory overclocking yields marginal (3-5%) hash rate gains

-

Liquid cooling solutions reduce power consumption by 6-9%

Hash Rate to Power Efficiency Trade-offs

The efficiency sweet spot occurs at:

-

Minimum Viable Threshold: 0.5 TH/s per 1000W

-

Optimal Range: 2-4 TH/s per 1000W

-

Diminishing Returns: Beyond 5 TH/s per 1000W

4. Kaspa Wallet Solutions and Security Protocols

Secure storage solutions require careful evaluation based on operational scale.

Web Wallet Implementation

Progressive Web App (PWA) Characteristics:

-

Instant access via browser (Chrome/Firefox recommended)

-

Client-side encryption with mnemonic seed backup

-

Transaction history limited to 200 most recent entries

Risk Assessment:

-

Phishing vulnerability score: 6.8/10

-

MITM attack susceptibility: Medium

-

Recommended maximum balance: ≤5,000 KAS

KDX Desktop Wallet Technical Specifications

System Requirements:

-

Storage: 8GB+ SSD recommended for full node

-

Memory: 16GB RAM for optimal performance

-

Network: 10Mbps+ sustained connection

Synchronization Process:

-

Initial header download (2-4 hours)

-

Full block verification (12-36 hours)

-

UTXO set compilation (4-8 hours)

Hardware Wallet Integration

Ledger Nano S/X Setup:

-

Install Kaspa app via Ledger Live

-

Configure KASVault interface (v2.1.7+ required)

-

Enable multi-signature protocols

Security Audit Findings:

-

EAL 6+ secure element certification

-

Physical tamper resistance: 9.2/10

-

Side-channel attack protection: AES-256 encryption

5. Kaspa Mining Profitability Analysis for 2025

Precise modeling requires multi-variable analysis.

Dynamic ROI Calculation Framework

Input Parameters:

-

Hardware acquisition cost

-

Local electricity rate ($/kWh)

-

Pool fees (0.5-2.0%)

-

Network difficulty growth projection

-

KAS price volatility coefficient

Calculation Model:

复制

下载

Daily Profit = (Hash Rate / Network Difficulty) * Block Reward * KAS Price * 86400 * (1 - Pool Fee) - (Power Consumption * 24 * Electricity Cost)

Regional Profitability Comparison

| Location | Electricity Cost | Breakeven KAS Price | 30-Day Projection (KS3) |

|---|---|---|---|

| Texas, USA | $0.068 | $0.022 | $310-$380 |

| Quebec, Canada | $0.052 | $0.019 | $340-$410 |

| Berlin, Germany | $0.283 | $0.097 | ($15)-$20 |

Tax Implications by Jurisdiction

-

USA: IRS Form 1099-MISC required for >$600 annual mining income

-

EU: VAT applicable on hardware purchases (19-25%)

-

China: Mining revenue classified as taxable business income

6. Comparative Study: Kaspa Mining vs. Bitcoin Mining

Technical and economic contrasts reveal strategic differences.

Architectural Comparison

| Parameter | Kaspa (BlockDAG) | Bitcoin (Blockchain) |

|---|---|---|

| Block Propagation | 500ms | 8-12 seconds |

| Orphan Rate | 0.1% | 2-4% |

| Storage Growth | 15GB/year | 350GB/year |

Energy Efficiency Metrics

-

Joules/TH: Kaspa (85), Bitcoin (110)

-

Carbon Intensity: Kaspa (38gCO2/KAS), Bitcoin (480gCO2/BTC)

-

Heat Recovery Potential: 20% higher with kHeavyHash vs SHA-256

7. Advanced Kaspa Mining Optimization Techniques

Professional-grade improvements for serious operators.

ASIC Firmware Modifications

Custom Tuning Options:

-

Voltage curve optimization (5-8% efficiency gain)

-

Frequency stepping algorithms

-

Fail-safe thermal throttling presets

Risk Factors:

-

Voided manufacturer warranties

-

Increased chip degradation potential

-

Stability issues during difficulty spikes

Industrial Cooling Solutions

Comparative Analysis:

| Method | Capex | Opex | Temp Reduction |

|---|---|---|---|

| Immersion | $3,200 | $0.02/TH | 18-22°C |

| Direct-to-Chip | $4,500 | $0.03/TH | 15-18°C |

| Air-Assisted | $1,200 | $0.05/TH | 8-12°C |

8. Future Outlook for Kaspa Mining

Projections based on current development trajectories.

Halving Schedule Impact

| Epoch | Block Height | Reward (KAS) | Projected Date |

|---|---|---|---|

| Current | – | 200 | – |

| First | 2,500,000 | 100 | Q2 2025 |

| Second | 5,000,000 | 50 | Q1 2026 |

ASIC Development Pipeline

-

2025 Q1: Bitmain KA4 prototype (projected 280 TH/s)

-

2025 Q3: IceRiver KS4 (rumored 40 TH/s)

-

2026: Potential 3nm chip designs

9. Troubleshooting Common Kaspa Mining Issues

Practical solutions for operational challenges.

Hash Rate Fluctuations

Diagnostic Checklist:

-

Verify firmware version compatibility

-

Inspect PCIe connection integrity

-

Monitor ambient temperature variations

-

Check for pool-side difficulties

Wallet Synchronization Problems

Resolution Protocol:

$ kaspa --resync --fast-sync --rpc-ip=127.0.0.1:16110

10. Strategic Conclusion: Evaluating Kaspa Mining Viability

Final recommendations based on current market conditions.

Investment Decision Matrix

| Scenario | Recommended Action |

|---|---|

| Electricity < $0.07/kWh | Immediate ASIC deployment |

| $0.07-$0.12/kWh | Wait for next-gen hardware |

| >$0.12/kWh | Cloud mining contracts |

Long-Term Sustainability

The Kaspa mining ecosystem shows promising characteristics for 24-36 month operations, though participants must remain vigilant regarding:

-

ASIC manufacturer competition dynamics

-

Regulatory developments in major markets

-

Alternative mining algorithm proposals

After comprehensive analysis, Kaspa mining presents viable opportunities for participants who:

✅ Have access to electricity costs below $0.15/kWh

✅ Can procure current-generation ASIC hardware

✅ Maintain realistic expectations regarding ROI timelines

Conversely, mining operations may prove financially unsustainable when:

❌ Electricity rates exceed $0.20/kWh

❌ Using outdated or inefficient hardware

❌ Anticipating immediate profitability

Final Assessment

This technical cryptocurrency mining machine guide has systematically examined:

✔ The fundamental principles underlying Kaspa’s mining protocol

✔ Optimal hardware configurations and software implementations

✔ Precise profitability modeling and cost analysis

✔ Future development projections

For prospective miners, the path forward involves careful economic analysis, strategic hardware acquisition, and ongoing performance optimization to maximize returns in Kaspa’s evolving mining landscape.